by Tamas Toth, Head of Global Customs and Foreign Trade, Ivoclar Vivadent AG

Unlocking Global Trade Efficiency: Introducing the Global Customs Footprint Tool – Your Guide to Strategic Resource Allocation and Risk Mitigation. Measure, Manage, and Master Customs Complexity for Optimal Business Performance.

Customs and foreign trade have become increasingly complex in recent times and despite some initiatives, will continue to be so on a global scale. As a result, customs professionals and teams within a company need to maintain focus and allocate resources correctly.

However, the question is how to decide what to take into account in the day-to-day work? What are the key elements of a decision about priorities and the next project? Should we just serve the loudest “bird in the nest”?

In this article I will share a tool that we have developed with my colleagues over the last years. For us, it has become a key tool to ensure transparency and a understand better of our risks.

There are probably some similar initiatives and solutions out there, we haven’t heard about yet. This is our one and we always make some small changes.

We share this happily, feel free to pick it up, adapt it to your needs and improve it.

(Our) Definition of Global Customs Footprint

The global customs footprint, as we call it, is the sum of all relevant costs or (quantifiable) cost avoidance associated with customs, namely:

- Customs duties paid (and if applicable, refunded)

- Customs clearance (brokerage) costs

- Cost avoidance (quantifiable)

- Other non-refundable import/export related taxes

I think that all these costs are generally understandable, and I would not go into detail, except for cost avoidance: the latter is all (quantifiable and no worth to mention COMPLIANT) actions and measures of the customs team that are not literally considered as savings, but the non-existence of those would cause payment of duties. Here we consider the benefits of a bonded warehouse or the use of FTA preference for intercompany shipments. In other words, this is kind of an achievement of the customs team.

Depending on the size of a company, the number of countries or plants it operates in, it can be a real challenge to get the right figure per plant or country. However, creating the same accounts for these costs globally is one way to consider (and how we do this).

We believe that the key element here, as is often the case, is to have reliable data. Once the data is available, the next step is easy, just use it…

Display of Global Customs Footprint

Well, how to display the collected data is in fact a matter of needs and personal preferences.

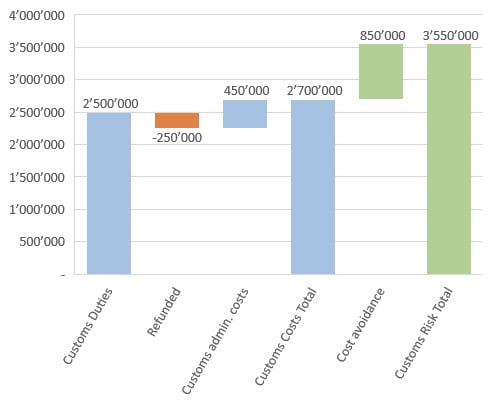

There is a possible presentation of the figures on the right (and just to remember these are fictive figures.

There are two totals that make sense however to display:

- Total customs related costs (duties, fees, administrative costs, minus refunded duty)

- Total customs related risks, which is again a sum of all customs total customs related costs plus cost avoidance.

The first is in general terms the figure that a company pays total in a year, and this is important for financials. The second is mostly a figure for the corporate risk officer. What lies in between, i.e. cost avoidance. Well, this figure shows, in among others, why there is a need for the customs team of well-qualified customs professionals in the company.

Global Customs Risk Map

Once we know a company’s duty payments, it is easy to work out the average duty rate for the imports. The visual representation of customs costs and average duty rates on a graph helps to improve the understanding and overview customs related risks: ideally, one can also create groups of low-medium-high risk plants based on their cost and/or average duty rate.

In our experience, this is a very effective tool for setting the right objectives and prioritising tasks, activities, or projects.

It is essential to focus on customs compliance in general. For all medium- and high-risk plants, this is simply a must.

The biggest missing criteria here is general administrative risk, burden. However, we do see a correlation to some extent between the average duty rate and the difficulty of customs clearance in a particular country.

Measurement the effects of customs – Custom-to-turnover Ratio

There is a general desire to have KPIs (Key Performance Indicators) to measure certain business activities. There are many good and bad examples of KPIs for customs, however there is probably a lack of a common, well-defined one.

The next one might be interesting and useful, what we call the customs-to-turnover ratio, which is a metric that is expressed as a percentage, the share of customs costs in total sales (for instance for a given year):

A high customs-to-turnover ratio may indicate that a company is paying a significant portion of its revenue in duties, affecting its profitability and competitiveness.

On the other hand, a lower (or over the time decreasing) ratio may indicate that the company is able to minimise its customs related costs:

Active management of the Global customs footprint

It seems obvious to regularly monitor the ratio of customs to turnover and to implement measures to optimise the payment of customs duties. However, the customs department alone is not sufficient to implement these measures.

At best, customs as topic is considered in nearly all business processes and decisions, starting from R&D, through procurement, production, supply chain to sales.

There are various customs initiatives that can be used, such as bonded warehouses, free trade zones for manufacturing or warehousing, inward or outward processing, drawback, temporary imports and exports, duty exemptions, etc…

The list of the opportunities and the explanation is so long that might serve as a subject of another article (or book…) and goes much beyond this article.

Implementing or successfully applying them can be a real challenge… but one thing is certain. All these initiatives used must be compliant.

Where to start? What initiative should be the first? Let’s go back, take a look at the global customs map… Start with the plants on the right (with high customs burden).

Well, this is it. I hope some of you find this useful and may adopt it.

Mr. Tamas Toth is an speaker at our Customs Compliance in Europe Conference

Mr. Tamas Toth, Head of Global Customs and Foreign Trade, Ivoclar Vivadent AG

Tamas joined the Hungarian Customs and Finance Guard right after finishing his studies for BA in Customs Administration in 2002, where he worked for almost 12 years in different positions. He was heading the excise and customs liaison and he contributed several EU projects as well.

In 2013 he obtained a MA in International Business and joined Tridonic Gmb & Co KG, Austria, as Global Customs and Export Manager, where he obtained relevant experience in customs compliance, customs valuation and foreign trade procedures and processes, like tariff classification or origin calculation.

As of November 2018, he has been working for Ivoclar Vivadent AG, in Liechtenstein and since January 2020 he is heading the Department for Global Customs and Foreign Trade. Together with his team, he is responsible for customs compliance globally and taking care of all foreign trade related topics, projects and systems.